One of the subjects that I've most wanted to write about here at South Beach Hoosier, and will at much greater length in the not too-distant future, complete with photos and presentation materials, are my ruminations about my personal involvement with two grassroots groups I was very involved in with both my head as well as my heart: the Arlington Baseball Coalition and Virginians for Baseball.

One of the subjects that I've most wanted to write about here at South Beach Hoosier, and will at much greater length in the not too-distant future, complete with photos and presentation materials, are my ruminations about my personal involvement with two grassroots groups I was very involved in with both my head as well as my heart: the Arlington Baseball Coalition and Virginians for Baseball.The effort to bring MLB baseball to Northern Virginia was a campaign -ultimately, a failed one- that I was deeply involved in on two separate occasions, over a period of ten years, until returning to South Florida in late 2003.

Despite the vast resources of the Northern Virginia area, both in terms of a highly desirable and well-educated population, and amazing demographic profiles and con$umer $pending pattern$, not to mention, the amazing amount of sheer talent and brain power of some of the most enthusiastic NOVA supporters -who wanted to see MLB relocate the Expos- of the Collins ownership group, led by Bill Collins, continually failed to develop anything even remotely like a logical and comprehensive marketing strategy.

That failure, shared my MANY people other than just Mr. Collins, was systematic and multi-level.

At its most basic level, they failed to take into account completely predictable human behavior: the determined efforts of a smart and organized opposition, particularly the failure to publicly acknowledge the oppostition of certain powerful Washington, D.C. parties, both private and within local and state governments.

Except in our case, we were fighting a two-front war: one against the folks who wanted a team in the District, and the second against various neighborhood groups -and pseudo-groups- in NOVA that didn't want a team near them, their homes or business, for reasons that ranged from the serious to the banal, despite their own admission that they were already there for the very same reason we wanted to be -great proximity to mass transit via the D.C. MetroRail.

(Among other notables associated with Mr. Collins' group were Mark Warner, before he was elected Virginia's governor in 1999, as well as veteran sportscaster James Brown, then with CBS-Sports, and a beloved, longtime Washington presence, in front and behind the camera.)

You can't simply ignore your opponents just because you want to give the impression of an inevitable victory, a lesson that shouldn't be lost on other well-intentioned South Florida civic groups trying to cobble together a winning coalition in an area like ours on transportation issues, where everyone's used to putting their parochial concerns above others in order to be heard.

Which Sounds like something that some of the Kendall groups that Transit Miami has been writing about lately.)

This failure to develop a simple, logical and comprehensive coalition of interest groups dedicated to the common goal of getting MLB back to the DC area, and to Northern Virginia specifically, showed a lack of common sense that was often breath-taking, I'm sorry to say.

Yet nobody ever seemed interested in adapting what we'd learned over time to the overall plan, so we kept making ther same mistakes over and over again.

Ouch!!!

Since the Harvard Business Review is clearly unlikely to memorialize their failed marketing campaign, it looks like it falls upon me to describe how you fail when you have the largest untapped media market in the country.

I'll also delve into the larger role of how the Washington Post, thru their Editorial Page pronouncements and curious story selection and placement, helped kill Northern Virgina's effort, in favor of the one The Post always favored.

That would've been one in The District, proper, and preferably, with a large minority participation, even if by by political/sports celebs like Colin Powell or Franklin Raines, then the head of Fannie Mae

Which is to say, men with nothing even remotely close to the baseball pedigree of the Collins Group, whose family had long been involved with minor league baseball.

In fact, it was at an early Minor League Baseball Caucus meeting on Capitol Hill in the early '90's where I first met Mr. Collins, his father and sister, all part of the collective effort over the years.

Those meetings on The Hill were chaired by then-NY congressman Sherwood Boehlert, one of the smartest and nicest persons I met in my 15 years in Washington, whose congressional district included Cooperstown.

Until I start anew, though, let me leave you with something to chew on: excerpts from two emails of mine from 2005.

The first was one I sent to a very talented writer in May of 2005, who'd written me earlier seeking some info on a matter that I was deeply involved with, and I wanted to connect some dots on the issue just to show him what was percolating out-of-sight.

The second email is an excerpt from a December 2005 email I sent to some knowledgable

friends around the country, who all had a connection to Washington, D.C. or baseball to some degree, and all of whom were also all-too-familiar with the behind-the-scenes manuvering and posturing then going on in the nation's capitol to get a foothold, however that could be accomplished.

And then, finally, the Washington Post finally started doing some hard-hitting stories on the shenanigans at Fannie Mae, whose head was one of the supposed stalking horses for a baseball team in Washington proper, and thus, the opposition for the groups that I was working with

___________________________________________________________

27 May 2005

re Colin Powell: How much does a Teflon mannequin cost these days?

Dear X:

For years one of the principal reasons I've turned to your stories on a consistent basis has been that your sensibility and interests closely seem to mirror my own, a comment that friends have constantly told me after I've turned them on via email to one of your funny, prescient articles that ask the questions nobody else will ask.

For years one of the principal reasons I've turned to your stories on a consistent basis has been that your sensibility and interests closely seem to mirror my own, a comment that friends have constantly told me after I've turned them on via email to one of your funny, prescient articles that ask the questions nobody else will ask.

Except this time, your column on Powell, good as it was, hardly even begins to scratch the surface on what's been afoot in DC over the past few years in the effort to bring MLB to the capitol area.

Allow me to connect the dots on some things that you don't know about, many of which are still galling and exasperating to me months and years after the fact because of my own long-time involvement in trying to bring MLB to Northern Virginia.

Where to start....

Where to start....

About two years ago, I was in the lobby of the Army-Navy Bldg. on Eye St., which as some one like you knows full well is the home of the New York Times' Washington Bureau.

As it happens, I have a ton of friends there at the paper and at the law firms there, as well as with former Minneapolis Star-Tribune folks who used to be there.

As it happens, I have a ton of friends there at the paper and at the law firms there, as well as with former Minneapolis Star-Tribune folks who used to be there.

(It's where my copy of Daily variety was delivered, just across the street from the MPAA- the Motion Picture Association of America.)

Late one afternoon, just after quitting time, I was talking to a bunch of my friends in the lobby, most of whom were African-American and either Times writers, editors or administration people. Not surprisingly, gieven what we'd be going back and forth about for awhile, the topic soon turned to the charade of what "black mannequin" Fred Malek would prop in his window for window dressing in order to co-opt both the DC City Council MLB and get the franchise.

FYI: I was VERY, VERY involved with the Northern Virginia effort tragically led my Bill Collins and his Gang That Couldn't Shoot Straight

I personally realized many years ago that he was far from the perfect vessel to bring a team to the area. Personally, I favored someone who was clearly intelligent, and personable if not charismatic, favoring someone like former VA Lt. Gov. Don Beyer of McLean or Gov. Mark Warner -who hadn't been elected yet- who's from Alexandria, since Collins was, I hate to say this, a bit of a sad sack in person.

(Many people called him "Grover Cleveland" for reasons that are obvious when you see him.)

Worst moment: We're in the penthouse of a very nice Arlington hotel near Pentagon City that's full of good food and drinks, and sports a spectacular 360 degree view of the area, including DC, for a press conference that announcing some new investors, as well as the latest on the Collins Group's efforts to lure MLB to NOVA.

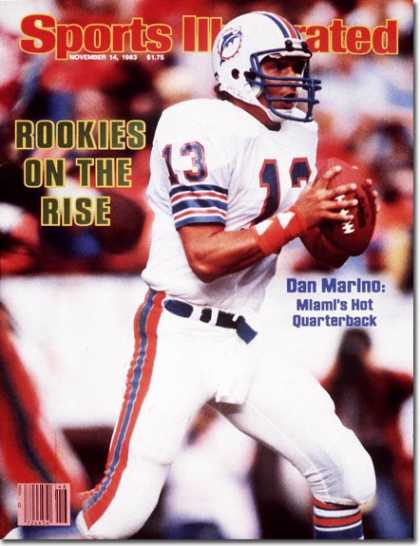

The reporters make quick work of the food, as expected, and after a terrific video narrated by James Brown of CBS Sports -a minority investor, along with a former Redskin whose name escapes me now!- you'd think this is when you turn on the hard-court press schmoozing, right?

Yet instead of doing that, the presentations are so leaden and cardboard -what is that weird combination called exactly?- that the attention of most of the men in the room was not on Collins or the members of his group, who, sadly, didn't realize like I did that you need to tell a more compelling hook and story than just 'Here's our new video that MLB just got... MLB tells us to be patient... Nope!

Though we'd spent lots of time and effort to make this information as accessible as possible, and had a real story to tell, the Channel 7 intern who had been assigned to event, a gorgeous blonde from FSU who looked straight out of a film noir flick, commanded everyone's attention.

These suits were no competition.

These suits were no competition.

As The Sports Junkies would say, it was a "debacle."

_________________________________________________________________

Monday Dec. 5th, 2005

Connecting the dots on some recent baseball matters:

So, former DC man of the moment Franklin Raines is going to use some of his ill-gotten loot

Connecting the dots on some recent baseball matters:

So, former DC man of the moment Franklin Raines is going to use some of his ill-gotten loot

to be a partner in one of the DC baseball groups, http://www.baseballindc.com/, i.e the Colin Powell, Darrell Green & Vernon Jordan group that didn't put up any real money?

So predictable.

Couldn't the Malek group at least make sure that the financial numbers on Raines' bio on the group's website were accurate? They sound fishy to me, given what we've discovered thru the congressional investigations that unmasked the phony numbers.

More than ten years ago, when I was very involved in the original Bill Collins' group effort to get a MLB team for Northern Virgina, I knew that no matter what, a character like Malek would still be around until the bitter end, no matter how cheap and transparent his efforts were, despite the fact that the Collins family already owned several well-regarded minor league teams.

(I'd met his father and sister at a Capitol Hill meeting of the Minor League Baseball Caucus in the early '90's, when the subject of MLB's antitrust exemption was being discussed -again.)

Even as late as the fall of 2003, when I left DC and returned to South Florida, Malek would never say publicly how much money his group would pony up towards stadium construction, while the Collins group was always willing to say that they'd do at least $100 million or one-third, whichever was greater, towards a $300-400 million stadium.

More than ten years ago, when I was very involved in the original Bill Collins' group effort to get a MLB team for Northern Virgina, I knew that no matter what, a character like Malek would still be around until the bitter end, no matter how cheap and transparent his efforts were, despite the fact that the Collins family already owned several well-regarded minor league teams.

(I'd met his father and sister at a Capitol Hill meeting of the Minor League Baseball Caucus in the early '90's, when the subject of MLB's antitrust exemption was being discussed -again.)

Even as late as the fall of 2003, when I left DC and returned to South Florida, Malek would never say publicly how much money his group would pony up towards stadium construction, while the Collins group was always willing to say that they'd do at least $100 million or one-third, whichever was greater, towards a $300-400 million stadium.

That the Washington Post's reporters never pinned him down on such a very basic question was a never-ending source of frustration to me, given the Post's clear desire for a MLB team to be located within DC proper, and not in the Northern Virginia suburbs, where most of the area's growing and affluent population -and baseball fans-actually lived.

The Collins Group, which then included present-VA Governor Mark Warner, FOX Sports' James Brown and a prominent ex-Redskin among many others, once held a great newser atop an Arlington penthouse hotel along the main Jefferson Davis Hwy. commercial strip on the way out to Reagan National Airport.

Our intent was simply to take the talk of getting a team out of the abstract and show in a very tangible way, the wonderful panoramic view of The National Mall and the monuments and NOVA from an ARLINGTON stadium site p.o.v., and how that would look on TV.

(Since I lived in Arlington at the time, and used the Metro everyday to and from work in downtown DC, this could've become the standard for combining future stadiums, transportation and a sense of public place -and be somewhere that people went even when nothing is scheduled, like the area near Camden Yards during the winter.)

The DC TV stations dutifully sent camera crews, but undercut us by sending mostly "fluff" reporters to the event, not sports people or political reporters, so they were ill-prepared to ask the kind of good, meaty questions that would actually get us -and them- much airtime.

The DC TV stations dutifully sent camera crews, but undercut us by sending mostly "fluff" reporters to the event, not sports people or political reporters, so they were ill-prepared to ask the kind of good, meaty questions that would actually get us -and them- much airtime.

For one of the few times, we actually provided a really great spread of food and drinks, and after some great state-of-the-art multi-media presentations, esp. James Brown's, we were really looking forward to schmoozing and spinning the crowd with facts and figures that would help us get our message out to the local audience, to undercut the Post's long-standing and conscious cold-water treatment of MLB in NOVA.

Unfortunately, most of the people there, 99% male, ended up paying closer attention to the drop-dead gorgeous, blonde ABC-7 -WJLA- intern from FSU, than they were to anything we were saying or showing them in our carefully prepared handouts.

After the prepared remarks, unaccustomed as most of the TV people there were to being at events where they had to engage in a certain amount of give and take with the participants, which sports or political reporters would be accustomed to, they either ran out the doors, or hung around demolishing the food and drinks and staring at the intern.

That was our Waterloo.

"I was defeated, you won the war..."

"I was defeated, you won the war..."

In a later conversation with the Ch. 7 cameraman, he told me that the intern's appearance -wish I'd written down her name!- often caused a commotion at events, and that for those reasons and many others he didn't want to get into at the time, most of the female reporters at the station didn't like having her around with them when they were covering a story.

Given the Marlins' pathetic and unprofessional attempts to get a baseball stadium down here since their World Series victory two years ago, from NOT having a savvy professional lobbyist in Tallahassee at important times -per Hank Goldberg's comments on his WQAM radio show- to not even having the support of a majority of the local members of the state House and Senate when you need THEIR help, it's sometimes a case of too much deja vu for me to stomach.

___________________________

Washington Post

New Paths for Mortgage Giants

Old Way of Doing Business Will Not Work Anymore For Fannie Mae, Freddie Mac

By Annys Shin

By Annys Shin

Washington Post Staff Writer

December 5, 2005

Struggling through the aftermath of multibillion-dollar accounting scandals, officials at Fannie Mae and Freddie Mac say their most difficult decisions may lie ahead. With stiffer competition from other companies and the changing tastes of home buyers in the types of loans they want, the companies face a choice between moving into riskier types of investing and acknowledging to stockholders that their potential for growth is limited.

In either case, company officials say, the business model that has generated record profit in recent years -- buying standard 30-year mortgages from banks so bankers would have more money to lend -- must change.

"Where in the olden days, you had a choice of selling your mortgage to Fannie Mae or Freddie Mac, in the future, there are lots of alternatives," a fact that has prompted a search for ways to diversify, Fannie Mae chief executive Daniel H. Mudd said in a recent interview.

The companies' options include becoming more deeply involved in the adjustable-rate mortgages that many consumers have preferred in recent years, financing more multifamily developments, and changing the standards for granting mortgages to take more risks with consumers who have spotty credit records.

The companies are even concerned about sustaining their staple business -- bundling mortgages into securities that are sold to investors throughout the world -- now that large institutions such as Countrywide Home Loans Inc., Lehman Brothers Inc. and Bear Stearns & Co. have moved into it. Fannie Mae and Freddie Mac's share of the mortgage-backed-securities business has fallen from more than 60 percent in 2000 to around 40 percent this year, according to the trade publication Inside Mortgage Finance.

District-based Fannie Mae and McLean-based Freddie Mac are two of the area's largest and most visible businesses, employing more than 8,000 in the region.

"The challenge for us is to reassert our presence in those areas where we've lost a bit of competitive advantage," said Patricia L. Cook, Freddie Mac's executive vice president for investment and capital markets.

The companies have not faced such fundamental questions about their underlying business model since the 1980s, when the collapse of the savings and loan industry under billions of dollars in bad debt pushed Fannie Mae into the red.

The current dilemma, in contrast, follows an era of explosive earnings growth at both firms, which helped turn a pair of bread-and-butter, government-chartered mortgage finance companies into high-performing growth stocks and prompted Fannie Mae chief executive Franklin D. Raines to promise Wall Street similar results far into the future. The companies' earnings, it was later disclosed, were inflated through accounting techniques that masked some investment losses.

Top executives, including Raines, were forced out, and the companies had to remove a combined $16 billion in profit from their books. Freddie Mac officials say they are nearing the point where they can produce reliable financial results. Fannie Mae is further behind and remains the subject of several federal investigations.

As they emerge from those crises, executives say part of their post-scandal life is to set more realistic expectations. Fannie Mae's stock is down about 30 percent this year, closing Friday at $47.99 a share. Freddie Mac's share price is off by slightly over 7 percent for the year and ended the week at $62.90.

"We've transitioned from growth to a value stock," Cook said. "The investment and analyst community appropriately expects us to be getting back to business."

The companies are also trying to cope with a mortgage industry much freer in its lending and much more likely to hold mortgages in-house for longer periods and with consumers more willing to take on riskier, adjustable-rate loans to keep their monthly payments down.

Fannie Mae, founded during the Great Depression to keep the home mortgage market liquid, and Freddie Mac, chartered in 1970 to compete, built their businesses around the fixed-rate, 30-year mortgage and a more conservative banking climate. Their presence, as a source of cash and a standard-setter for how to rate mortgage applicants, encouraged banks to lend money. Lenders could initiate loans and pocket the fees, confident that as long as the borrower met Fannie Mae's or Freddie Mac's standards, they could resell the loans to one of them, get their capital back, and make another loan.

Fannie Mae, founded during the Great Depression to keep the home mortgage market liquid, and Freddie Mac, chartered in 1970 to compete, built their businesses around the fixed-rate, 30-year mortgage and a more conservative banking climate. Their presence, as a source of cash and a standard-setter for how to rate mortgage applicants, encouraged banks to lend money. Lenders could initiate loans and pocket the fees, confident that as long as the borrower met Fannie Mae's or Freddie Mac's standards, they could resell the loans to one of them, get their capital back, and make another loan.

The companies tended to shy away from delving too deeply into adjustable-rate and other unconventional mortgages, regarding them as too risky. Such loans, however, have soared in popularity and now account for more than 30 percent of U.S. home mortgages issued in 2004, said Dale Westhoff, Bear Stearns's senior managing director of mortgage research.

In contrast, loans that conform to Fannie Mae and Freddie Mac's basic guidelines -- the companies cannot, for example, accept loans of more than $417,000 because their basic mission is to support middle- and low-income housing -- have fallen from more than 62 percent of loans issued in 2003 to less than 36 percent of loans issued this year, according to Inside Mortgage Finance.

"So much of the new mortgages don't fit into their framework," said William C. Apgar Jr., a former assistant housing and urban development secretary now with Harvard University's Joint Center for Housing Studies. "Fannie and Freddie did a big service taking a relatively unorganized system and saying, 'If you present a mortgage of this type, we can bundle them together and sell them to investors.' Now the flow of product is so much more complex and requires so much information," he said.

"Fannie and Freddie haven't figured out a way to get into that segment of the market," Apgar said. "They're constrained because of their concern about how well they can manage that risk."

Demand for adjustable-rate mortgages has begun to taper off lately as interest rates have risen. But housing finance experts say adjustable-rate mortgages are here to stay.

Demand for adjustable-rate mortgages has begun to taper off lately as interest rates have risen. But housing finance experts say adjustable-rate mortgages are here to stay.

"It's unlikely Fannie Mae and Freddie Mac will ever see the market shares they saw in the early 2000s," Westhoff said. "We will continue to see a higher share of adjustable-rate mortgages than we've seen historically."

Fannie Mae and Freddie Mac are not willing to let the market pass them by. Executives of both companies argued that they will have to adapt to fulfill their government-chartered mission to keep money flowing into the housing market.

"As we look at our business, we realize we have a special role to fulfill in the market," Mudd said. "Various strategies we may consider clearly need to be examined in terms of our mission to support the market and help low- and middle-income families." Mudd said that after the firm puts its accounting problems behind it, it will "participate in more markets with more products... and more flexible products for people with a credit blemish on their record and for first-time minority home buyers."

Freddie Mac already has stepped up its investment in adjustable-rate mortgages, although about 80 percent of its holdings still are long-term, fixed-rate loans.

As the firms look for new ways to grow, both will have to be careful not to grow too much. Their investment portfolios, which grew rapidly in the 1990s, were a major source of the accounting violations at both companies. Congress is considering legislation that would give a new regulator for Fannie Mae and Freddie Mac varying levels of authority to scale back the size of their holdings. A Senate proposal would limit the kinds of assets they can hold.

Fannie Mae and Freddie Mac have already been forced to become smaller to satisfy regulatory requirements, shedding a combined $200 billion in portfolio holdings.

"The market is so competitive that even if our favored and friendliest customer sees us as being off by a [tenth of a] point, they're going to sell the business to somewhere else," Mudd said.

"We've got to build the company to manage that and be ready for it."

_________________________________

Baseball and the District: Dancing With Wolves

By Mike Wise

November 26, 2005

The home stretch is upon the men who want to own Washington's baseball team, and this is how they look plodding toward the post:

The home stretch is upon the men who want to own Washington's baseball team, and this is how they look plodding toward the post:

Ted Lerner has become more reclusive than Howard Hughes, as accessible as Thomas Pynchon or J.D. Salinger. (Does anyone know what Lerner looks like? When he was last seen?) I know baseball told everyone to stay mum, but this man has duct-taped his lips. His bid was probably air mailed from Guam.

Jeff Smulyan can be seen grinning in celluloid, campaigning harder than John Kerry. The Indianapolis media mogul is so desperate to erase the portrayal of himself as the outsider, he returned my call. Soon enough, he'll be on stage with Bruce Springsteen in a barn jacket.

And Fred Malek? Poor Fred Malek. He sent Colin Powell last week to lobby the D.C. Council on his group's behalf. Imagine the indignity for such a great American with just a infinitesimal financial stake in Malek's group: One minute, you're addressing the United Nations on matters of global security, the next, you're at Corner Bakery with Jack Evans and Anthony Williams. Very disconcerting.

Fortunately, it's almost over. And this is how it will most likely go down: The penny-wrangling between the District and Major League Baseball should end in about a week, the final details of a lease for a new stadium to be worked out.

By Friday, Stan Kasten, the former Braves president, will have met with Bud Selig and formally be told, "Join forces with Lerner because we all know your group is toast."

Smulyan's group will also meet with Selig, and the commissioner will then make his final call. Within two weeks, at the latest, the Nationals will no longer be on the baseball public-assistance plan. They'll have a real live owner, not to mention the final touches on plans for a new stadium. This is just a hunch, but it will probably be announced at a joint press conference.

Which rich guy should it be? Only Bud knows.

Which rich guy should it be? Only Bud knows.

Reading Selig, the only tea leaf in baseball that matters, is akin to living your life by horoscope: You hear what you want to hear, not what you need to hear. Beyond the rhetoric, here is what Selig is weighing in a two-, maybe three-horse race, depending whether you're in the camp of Smulyan or Malek.

(By the way, Malek's big supporter, the lame-duck mayor, has really come up small on this issue. While baseball was trying to sew up the lease deal, Williams left town. Williams has tethered his legacy to the economic redevelopment of Washington, and for more than a year baseball has been his baby. It's time he was there to see it grow up.)

Lerner is purported to have the inside track for two reasons. One, he is of D.C., which, perception-wise, means he loves Washington too much to move the Nationals. Two, baseball is happy he adhered to its secrecy request. With the way he has comported himself in this campaign, Lerner is someone baseball feels could carry the ownership banner without making a spectacle of himself. If a baseball man like Kasten is added to the mix, well, that erases the inexperience factor.

Smulyan is still in the running for several reasons. Cold-calling, grabbing everyone he can, he has enlisted a number of local investors, who happen to be black. They include Alfred Liggins, Rodney Hunt and Jeffrey Thompson, who brought along two of Joe Gibbs's former players, Art Monk and Charles Mann. Including Eric Holder and Bill Jarvis, Smulyan's group of African-American owners would represent the largest minority ownership in baseball, some $50 million. And Selig wants to champion diversity at the highest levels of the game. Further, some feel he has the backing of old friend Jerry Reinsdorf, the man Selig charged with assembling the cast of buyers.

Smulyan's ownership history in Seattle hurts him (cash-strapped and hamstrung by a stadium lease, he sold the team in 1992), but at least he's been there.

Any vote to move the team would be taken by the club's Washington owners, not Smulyan. Smulyan has removed himself from the equation just to make sure people believe him when he says he is not the second coming of Bob Short, who moved the Senators some 30 years ago.

"If you believe nothing I've ever said, let me say this: Indianapolis is never going to get baseball," Smulyan said in a telephone interview yesterday. "The value of the team is in Washington. Why would someone spend $450 million to buy a team in the fifth-largest media market and the area with the country's second- or third-most disposable income and then move it? Nobody is that dumb. Not even me.

"If you believe nothing I've ever said, let me say this: Indianapolis is never going to get baseball," Smulyan said in a telephone interview yesterday. "The value of the team is in Washington. Why would someone spend $450 million to buy a team in the fifth-largest media market and the area with the country's second- or third-most disposable income and then move it? Nobody is that dumb. Not even me.

"I'll buy a home there, I'll be there. Nobody will work harder than we will."

Take it easy, Senator. We know you want to be president.

Malek's group is still smarting from the perception, wrongly or not, that it initiated the negative campaign against Smulyan. Baseball does not like connivers, and only puts up with them because George Steinbrenner makes it. There is the existing relationship between the city and the Malek group to promote baseball in the district dating back several years. Before anybody believed a return was possible, Malek was the forefront of the movement, and the mayor has been loyal to him.

But his past has come back to haunt him, too. Though prominent Jewish leaders have said Malek has atoned for his role as a Nixon White House aide who counted the number of Jews working at the Bureau of Labor Statistics, it's still out there.

Asked if he believed the Malek group was behind the out-of-town characterization and whether Smulyan's Jewish faith had anything to do wit h it, Smulyan said: "You hear things, but I can't believe that. I don't think there's any anti-Semitism involved. If I would have been part of a group of Episcopal bishops from out of town, the same thing would have happened."

I'm still perplexed by the localism issue. How is the area you live in more important than the stewardship of the team? This entire Sale-By-Zip-Code rationale has got to stop. After all, Bob Short lived in Washington for 15 years before he moved the team. The Griffith family lived in the District only their entire lives before they made sure baseball left Washington the first time.

Shouldn't more pressing issues be on the table at this point? Like, who is going to bring in wonder boy Theo Epstein? He's 31. He does not want to work for Larry Lucchino and the Red Sox anymore and he has direct ties to Washington.

Shouldn't more pressing issues be on the table at this point? Like, who is going to bring in wonder boy Theo Epstein? He's 31. He does not want to work for Larry Lucchino and the Red Sox anymore and he has direct ties to Washington.

(Okay, so his sister is merely a writer on the new Geena Davis series, "Commander in Chief." That counts, right?) The point is, it's getting late in the game. It's time to pick someone in this race, and I don't care what Selig is thinking. I'm going with Smulyan in the hopes he can bring in a rock star like Theo to lure some rock-star players.

What? The guy called me back.

2005 The Washington Post Company

2005 The Washington Post Company

+Sep+10,+1984.jpg)